Implementing Data Analysis for Operational Optimization and Increased Business Performance

Businesses today have access to more data than ever before, from customer transactions and interactions to operational metrics and financial …

21 | 09 | 2020

21 | 09 | 2020 The past decade has been booming with thousands of various tech-related projects that promise to transform our lives. Indeed, in an era of digitalization, it is hard to imagine our lives without the technologies. We use them every day, sometimes without even paying attention to that. And there’s nothing bad in that. Even more so, the industries today not only travel side by side creating new products and services, they closely interact with one another aiming at providing a novelty to the world through custom software solutions that change our daily life.

The financial industry today is inextricably linked and is deeply rooted in all business sectors, you name it. With e-commerce popularization and the COVID-19 global pandemic, many people prefer going online for different types of services and purchases. And who we are to blame them. You buy food or household items online; you buy clothes for you and your family online; you order dinner online; you watch movies online. And that is a new normal which has led to the establishment of online payment systems, online banking, and many more. And that’s the fintech right there, it rocks today. It’s everywhere and it is continuing its growth.

Wikipedia defines the term “financial technology” (or fintech) as the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. In other words, companies involved in the financial sector utilize technologies in their daily operations to grow their businesses and create the best experience for their users and partners.

The fintech today has been widely used in banking, investment, trading, insurance, e-commerce, education, fundraising, nonprofit, cryptocurrencies, etc. hence, it obtained a broader meaning, whereas earlier the term appertained to the back-end technologies for banking and trading mainly.

According to the latest researches, fintech innovations today comprises of the two main areas:

More and more companies worldwide address the software development companies to not only react to the financial market changes but also want to alter along with it.

READ ALSO: DATA MINING COMPLEX SOLUTION FOR FINTECH INDUSTRY

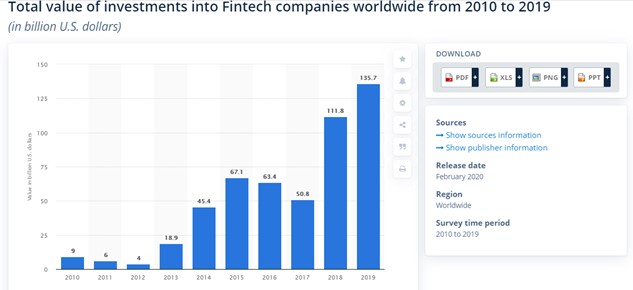

The startups are viewed as those to have triggered the fintech domain transformation into the way we know it today. With fresh ideas and vision along with the increasing number of smartphone users, the course shift into the tech direction was inevitable. And global financial giants have had to keep up. The growing competition for partners, investors, and customers opened new vistas for multiple businesses to emerge on the market having a lot to offer since the niche remained “classy” in terms of financial management. Within the last decade, the fintech industry investment has grown to reach $135.7 billion in 2019.

From these numbers, we observe an enormous surge in investment into the technological side of the financial sector. And considering the current global political and economic situation, the fintech industry will only bolster its positions. This is one of the reasons why software development companies are switching their focus too. This is the technological innovation that drives the fintech into the future. The users consume more personalized products or services; therefore, they return for more and stay. To attract more clients, it is no longer enough to provide a service or sell a product. People want more, and, unless your business cannot satisfy those needs, you are most likely to be out.

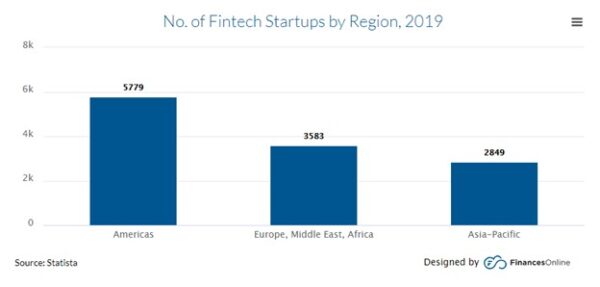

As of 2019, the Americas are leaders in the number of fintech startups: 5779 companies solely are located here; whereas, Europe, Middle East, and Africa are home to a little over 3500. However, the largest fintech company is Ant Financial and it is located in China.

According to KPMG’s Fintech 100, the companies’ distribution inside the fintech based on the sectoral break up in their report are:

Based on this statistic we can see that the demand for online payments and transactions is very high; therefore, more and more new startups are expected to emerge.

It’s a no brainer that any young industry faces certain challenges down the road. Not to mention such a rapid pace the fintech has started with. Facing highly-resistant old-school financial institutions opposing the new technologies and custom software solutions was not easy, however, they were defeated and started implementing them as well to stay in business and grow bigger.

When a startup appears with a grandiose idea or innovative vision, not everything runs smoothly for them as well. So, what potential challenges the fintech companies encounter in their way to success? And what shall the industry do to overcome these?

For many years now, professionals worldwide argue that the development of AI and robotic technologies will take jobs from humans. The tendency today, however, shows the opposite: the tech market has caused the creation of more workplaces for the professionals to be involved in software development and hardware production rather than taking those jobs. Of course, less well-educated people, whose jobs are most likely to be automated in the future, have encountered a decrease in wages due to the over-supply of the workforce. On the opposite, the wages are growing for those individuals that are well educated, study constantly, and participate in various webinars, conferences, master-classes, etc. JPMorgan Chase’s CEO, Jamies Dimon described this situation as follows:

“Unfortunately, too many people are stuck in low-skill jobs that have no future and too many businesses cannot find the skilled workers they need.”

With the development of the IT industry, many companies have implemented corporate learning for their senior staff members to help them grow and develop their skillset and withstand the competition with younger peers. With fintech, being a comparatively young industry, it still faces a shortage in a skilled workforce to satisfy the demand to the fullest extent. Thus, only those who are quick-learning and flexible are most likely to succeed in this changing and crazy world.

The occurrence of new industries or their domain requires an immediate reaction from the governments that will regulate the legal side of that domain and establish a scope of laws to protect the target users from the potential risks. The development of the internet, social media, and different applications have caused numerous revisions of the existing legislation to keep up with the new rules. The governments aiming to protect the personal data of their citizens have had to set the boundaries for the companies that operate with personal data to limit their powers, hence, ensure that no third-party (without a due authority) can access these data. That was the main reason why the European governments have adopted the GDPR aiming to protect the intellectual property and other personal sensitive data users grant access to while using different apps and services.

In the fintech domain, the issue of data security is at its highest, since it deals with the personal assets of an individual or a corporation. That is the key reason why fintech companies utilize all possible services to provide the respective security level with several authorization steps.

Many people find virtual security challenging saying that it is easier to hack someone’s virtual account and steal their money, which can happen, of course, but all fintech apps that deal with finances and bank accounts establish a high level of security. Usually, these are biometric and/or two-factor authentication, in-app real-time alerts, encrypted data, etc. The systems, if are entitled, may send you the alerts when you leave your usual location area, like travel to another city or country.

Modern fintech companies rely on security a lot, therefore, they put their systems under harsh testing using both security and penetration testing to make sure the apps or services they provide are not vulnerable to any external interference or attack.

The geography of technologies adoption and popularization is expanding, hence, redefining the future of every industry. There is no longer a clear definition of traditional thinking when it comes to fintech. Although a vast number of people still are and most likely will in the future opt for the traditional financial services or banks, the technology is getting rooted in there as well.

With the number of fintech organizations growing, the demands toward the legal data management are getting higher as well. Creating a GDPR-compliant service, product or environment will be beneficial for a business and opens new growth opportunities, the attraction of new clients, and partners. Only those users who feel secure and protected can make up their minds in favor of service. It is deemed necessary to ensure that all personal data your customers expose to you are protected and won’t leak elsewhere.

Data-driven innovations shape the world of today and provide novelty solutions for the data-related problems that have not been yet solved. Even though it is AI that is normally behind the services or products, the users are indeed treated more humanly than they are sometimes in person. And that is the key to success: the customers and their needs come first.

Having expertise in creating custom software solutions for fintech, Agiliway sees the future of Big Data innovations as the main key to success. If you need help with implementing the product that will become the next leader of the fintech industry, contact our team for the consultation.

READ MORE: FINTECH

Businesses today have access to more data than ever before, from customer transactions and interactions to operational metrics and financial …

Conversational AI systems can engage in natural conversations and dialogue with humans. Powered by machine learning and natural language processing, …

The decision between hiring a software development company or a freelancer can be challenging for business owners who are looking …